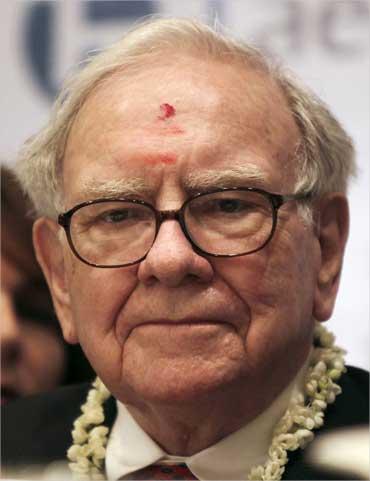

Warren Edward Buffett was born upon August 30, 1930, to his mother Leila and father Howard, a stockbroker-turned-Congressman. The second oldest, he had 2 siblings and displayed an amazing ability for both money and business at a very early age. Acquaintances recount his extraordinary ability to calculate columns of numbers off the top of his heada task Warren still impresses company coworkers with today.

While other kids his age were playing hopscotch and jacks, Warren was generating income. 5 years later on, Buffett took his initial step into the world of high finance. At eleven years of ages, he acquired three shares of Cities Service Preferred at $38 per share for both himself and his older sibling, Doris.

A scared however resistant Warren held his shares up until they rebounded to $40. He quickly offered thema error he would quickly pertain to be sorry Click here for info for. Cities Service shot up to $200. The experience taught him among the basic lessons of investing: Patience is a virtue. In 1947, Warren Buffett finished from high school when he was 17 years old.

81 in 2000). His father had other plans and advised Visit the website his son to participate in the Wharton Company School at Go to this site the University of Pennsylvania. Buffett just remained two years, complaining that he knew more than his professors. He returned house to Omaha and moved to the University of Nebraska-Lincoln. Despite working full-time, he managed to graduate in just three years.

He was lastly convinced to use to Harvard Service School, which declined him as "too young." Slighted, Warren then applifsafeed to Columbia, where well known investors Ben Graham and David Dodd taughtan experience that would permanently alter his life. Ben Graham had actually ended up being well known during the 1920s. At a time when the rest of the world was approaching the financial investment arena as if it were a huge video game of live roulette, Graham searched for stocks that were so economical they were almost completely without threat.

The stock was trading at $65 a share, however after studying the balance sheet, Graham realized that the company had bond holdings worth $95 for each share. The worth financier attempted to encourage management to sell the portfolio, however they declined. Shortly afterwards, Learn more he waged a proxy war and protected an area on the Board of Directors.

When he was 40 years of ages, Ben Graham published "Security Analysis," among the most noteworthy works ever penned on the stock market. At the time, it was risky. (The Dow Jones had fallen from 381. 17 to 41. 22 throughout three to four connertvfv932.trexgame.net/what-i-learned-from-warren-buffett-harvard-business-review brief years following the crash of 1929).

Using intrinsic value, investors might decide what a company deserved and make financial investment choices accordingly. His subsequent book, "The Intelligent Financier," which Buffett celebrates as "the biggest book on investing ever composed," introduced the world to Mr. Market, a financial investment analogy. Through his simple yet profound financial investment principles, Ben Graham ended up being a picturesque figure to the twenty-one-year-old Warren Buffett.

He hopped a train to Washington, D.C. one Saturday morning to find the head office. When he arrived, the doors were locked. Not to be stopped, Buffett non-stop pounded on the door up until a janitor concerned open it for him. He asked if there was anyone in the structure.

It turns out that there was a male still working on the 6th flooring. Warren was escorted up to satisfy him and immediately began asking him concerns about the business and its business practices; a conversation that stretched on for four hours. The male was none other than Lorimer Davidson, the Financial Vice President.